Like chocolate and social media, credit cards are wonderful as well as potentially terrible, depending on how they’re used. When handled correctly, credit cards are an excellent way for you to demonstrate fiscal responsibility and boost your credit rating. (Which may help explain why they’re more popular than ever before.) One industry study found only 14% of American consumers use cash for everyday purchases. And another reported that 75% of those surveyed preferred paying for small purchases with a credit or debit card. So if you’re going to use them anyway, we’ll list credit card rules below to help you stay within your budget.

Credit Card Rules Can Help You Avoid Emotional Spending Traps

People enjoy the convenience of credit cards and their limited liability. There’s only one tiny issue: According to research published in Psychology Today, people spend more when using credit cards. In one study, for example, participants were willing to spend $175 to throw a Thanksgiving party paid for using credit. However, those same respondents were only willing to pay $145 when using cash.

But since plastic isn’t going anywhere, putting some credit card rules into place can help you use it wisely.

Three Credit Card Rules That Help You Spend Less While Boosting Your FICO Score

Even if you prefer using cash over credit cards, it’s not a good idea to avoid them altogether. A credit card is a tool, when used with caution. And just like any sharp knife or heavy hammer, it stays useful as long as you wield it with care. Heed these three credit card rules to spend less, save more, and raise your credit score.

Rule #1: Set it and forget it

To get the credit stability benefits without shopping just because you can, set up autopay for 1-2 monthly utility bills. (That way, you’ll know exactly how much you’re putting on your card and when those payments are due each month.) Then, set up an automatic draft with your bank account to pay that credit card bill a few days later. With minimal effort, you’ll gradually improve your credit score and ensure you’re never late on your water or electricity bill.

Rule #2: Ask For The Lowest APR Possible & No Annual Fees

Everything is a negotiation, and that’s especially true for the financial services industry. Do you usually carry a balance from month to month, but always pay on time? Then ask your provider to lower your annual percentage rate (APR) and/or raise your credit limit. Carrying a monthly balance makes lowering your APR a better deal for you, so start with your oldest card first.

Worried about negotiating over the phone with your creditor? Arm yourself by finding one or two competing credit cards that have lower APRs and keep that info handy. Then, ask politely if your current provider can match or beat these interest rates based on your exemplary payment history. Lowered APR saves you money each month, and an increased limit with no late payments can boost your credit rating.

Since the 2009 Credit CARD Act passed, by law, card companies and loan issuers must show customers their current APR. The reason is simple: Customers deserve to have a clear understanding of the actual rates listed in their cardholder agreements. A provider may charge 1% a month, for example, so the APR is 1% multiplied by 12 months, or 12%. (This would be a fairly low rate; 18% is more typical for most current credit cards.) But again, if you’re a long-time customer who’s never paid late, it pays to ask for the lowest rate possible.

Not sure what constitutes “good payment history” when asking to lower your APR? Look at your last 6-12 credit card statements. If you’ve paid on time for the last six months to a year, confidently ask them to lower your APR.

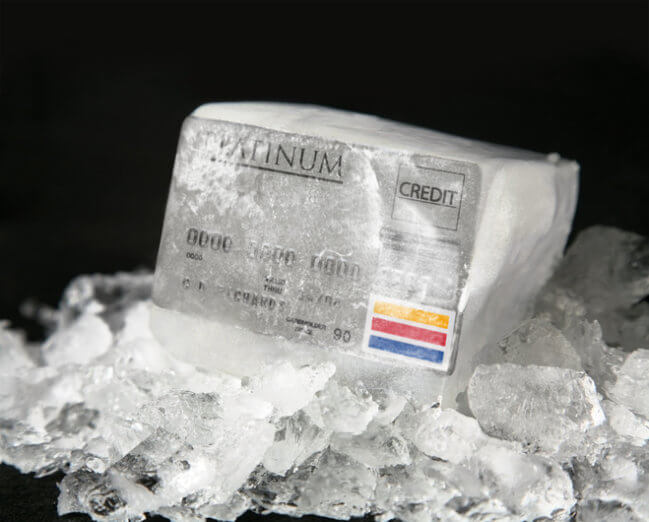

Rule #3: Freeze It — Literally!

Of all three credit card rules on our list, this one might actually be fun for you to try. There’s just something so satisfying about cutting up a card — particularly when you’ve paid it off after several stressful years. But hold up one second: After paying off your balance, don’t run for the scissors to cut that card up! Having an intact credit card in your possession doesn’t mean you have to use it. Remember: These credit card rules are designed to help improve your FICO score, which includes optimizing your credit utilization ratio.

First, call the number on the back of your paid-off credit card to ensure you don’t owe any annual fees. Then, get creative. Fill a small plastic bowl with water, drop the card in and freeze it. (Tupperware is ideal for this.) This way, you still have line of credit open to use in case of an emergency that isn’t easily available. The idea is to make using the card a hassle for everyday expenses — but not impossible when true emergencies arise.